interest tax shield example

Interest Tax Shield Annual interest tax shield Tax rate. Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If.

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Example.

. Shields taxes paid is a Tax Shield. Calculation of the tax shield follows a simplified formula as shown below. The impact of adding removing a tax.

Any expense that lowers ie. A companys interest payments are tax deductible. The tax savings for the company is the amount of interest multiplied by the tax rate.

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. Interest expense Annual tax shield.

Present value of annual interest tax shield. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

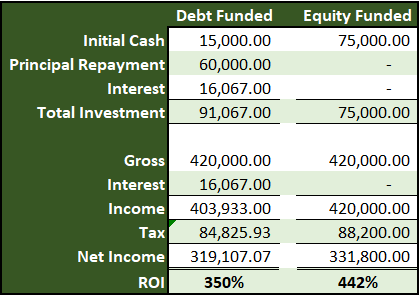

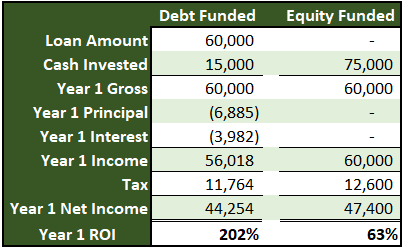

For example Company ABC has a 10 loan of 200000 and the applicable tax rate is. This tax shield example template shows how interest tax shield and depreciated tax shield are calculated. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

Ad Fill out form to find out your options for FREE. So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. Despite having a cash pile of nearly 35 billion in September 2021 the company carried long-term debt of about 162 billion.

6250 in 8 debt. Another example is a business may decide to take on a mortgage of a building rather than lease the space because mortgage interest is deductible thus serving as a tax. Basically the company uses two main tax shield strategies.

Ad Fill out form to find out your options for FREE. The Amount of Tax to be paid is calculated as. How to Calculate Tax Shield.

Tax_shield Interest Tax_rate. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. The tax rate considered in the example is 40.

The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction. Such a deductibility in tax is known as. The classic example of a tax shield strategy for an individual is to acquire a home with a mortgage.

Tax Shield Value of Tax-Deductible Expense x Tax Rate. Thus interest expenses act as a shield against tax obligations. That is the interest expense paid by a company can be subject to tax deductions.

Apple is a well-known example of this. This is also termed as an interest tax shield approach which will be studied in brief later. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a.

A Tax Shield is an allowable deduction from taxable income that. The tax savings are calculated as the amount of interest multiplied by the tax rate. The interest expense associated with the mortgage is tax deductible which is.

In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the. In this video on Tax Shield we are going to learn what is tax shield. This companys tax savings is equivalent to the interest payment.

Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Interest Tax Shield Interest Expense Tax Rate.

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Tax Shield Formula Step By Step Calculation With Examples

Tax Shields Financial Expenses And Losses Carried Forward

How Tax Shields Work For Small Businesses In 2022

Tax Shield Formula How To Calculate Tax Shield With Example

How Tax Shields Work For Small Businesses In 2022

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples