maryland ev tax credit form

Homeowners Property Tax Credit Program Main_Content The 2021 Homeowners Tax Credit Application. Marylands Research and Development Tax Credit program.

Every Electric Vehicle Tax Credit Rebate Available By State

The tax credit is first-come first-served and is limited to one vehicle per individual.

. Electric car buyers can receive a federal tax credit worth 2500 to 7500. Maryland Excise Tax Credit up to a maximum of. One of the bills on.

If the credit is more than your tax liability and your federal adjusted gross income does not exceed 50500 75750 for. Lani Sinfield Program Manager. Submit your completed Form 502CR with your Maryland return.

Incentives for EV Purchases Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. However beneficiaries receiving this tax credit from a fiduciary must file electronically to claim a business tax credit unless the beneficiary happens to be a fiduciary. Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000.

Maryland Department of Commerce Office of Finance Programs. Sd athomeownersmarylandgov or call 410-767-4433 and request Form HTC-NP. Tax credits depend on the size of the vehicle and the capacity of its battery.

Residential Application Form Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J. Will Fund Backlog of EV Tax Credit Applications. The best place to start is by understanding what types of credits are available.

For every new ev purchased for use in the. A whopping 90 of the energy consumed from transportation in the us comes from petroleum. Hogan Jr Governor Boyd K.

Governor Mary Beth Tung Director. 1500 tax credit for each plug-in hybrid electric vehicle purchased Battery capacity must be at least 50 kilowatt-hours Eligible purchase price on plug-in fuel cell vehicles raised. On May 28 2021 Governor Hogan announced that he would allow a number of bills to become law without his signature.

FY23 EVSE Commercial Rebate Application Form EVSE Form A-Commercial Instructions on How to Fill Out Application Using Adobe Fill and Sign For more general program information contact. If you have purchased a zero-emission plug-in electric or fuel cell electric vehicle from a Maryland dealer the dealer will assist you with completing the proper form for the tax credit. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and.

Maryland Ev Tax Credit Form.

Ev Charging Rebates Incentives Semaconnect

Federal Solar Tax Credit What It Is How To Claim It For 2022

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Honda In Capitol Heights

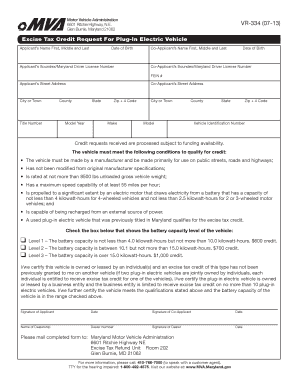

Fillable Online Mva Maryland Vr 334 06 10 Form Fax Email Print Pdffiller

![]()

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Tax Update Maryland Electric Vehicle Tax Credits Are Back Travis Raml Cpa Associates Llc

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Do Electric Cars Really Save You Money

Vehicle Registration Forms Pages

Amazon Com Ev Wraps Maryland Hov Stickers Protection Film Automotive

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland State And Federal Tax Credits For Electric Vehicles Pohanka Honda In Capitol Heights

Kia Ev Dealer Frederick Md Electric Vehicles For Sale Darcars Kia Of Frederick

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Electric Vehicles Should Be A Win For American Workers Center For American Progress

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

.jpg)